The world economy has significantly recovered since the lows of 2020 and, in most developed markets, it is close to pre-pandemic levels. However, as some of the support programmes are being progressively withdrawn, investors are closely watching economic data to assess whether the economy has enough momentum to continue the recovery without additional liquidity injections from governments and central banks.

The world economy has significantly recovered since the lows of 2020 and, in most developed markets, it is close to pre-pandemic levels. However, as some of the support programmes are being progressively withdrawn, investors are closely watching economic data to assess whether the economy has enough momentum to continue the recovery without additional liquidity injections from governments and central banks.

Equity markets were a little bit volatile during the month, as weaker-than-expected US consumer data points and delta-variant infection levels looked like triggering a mid-month sell-off. However, most main equity indices finished the month positive, as the main economic narrative did not change. Chinese equity indices continue to lag, as the consequences to corporations of the government’s new priority to reduce inequalities across the population remain uncertain. In terms of style, growth stocks outperformed, with consensus believing that economic growth indicators might have peaked.

In terms of fixed income, sovereign and corporate credit remained very tight, with spreads close to, or at, all-time lows. Yields on US and European sovereign issues have marginally increased, anticipating future reductions of liquidity injections.

The HFRX Global Hedge Fund EUR returned +0.59% for the month.

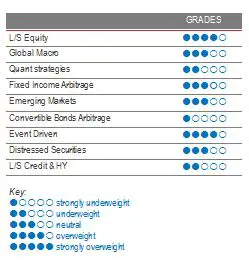

Long Short Equity

August was, overall, a good month for Long Short Equity strategies, with decent performances from managers within the different styles spectrum. Strategies with a small-cap focus lagged the broad universe, being, on average, slightly negative, but, year-to-date, they are one of the best-performing styles. Since the start of the year, alpha generation across the industry has been one of the poorest over the last 10 years, due mainly to a poor short-position attribution. In terms of performance, year-to-date, Long Short Equity funds have generated, on average, mid-single-digit returns in North America, Europe and Asia. However, on a relative basis, Asian funds have outperformed, capturing more than 100% of positive returns in the main indices while the upside capture ratios for US and European funds have been quite muted. We think that the short book might be an important asset for the rest of 2021 as equity valuations remain very stretched and sensitive to bad surprises. We believe the risk-reward is in favour of Long Short Equity strategies going forward, as, benefiting from increased intra-sector dispersion, they will try to use their short books to capture the excesses of liquidity flowing into the markets and particularly dislocations in work-from-home beneficiaries.

Global Macro

Returns were dispersed for the month, which is understandable, considering markets were relatively choppy during August. Global Macro strategies have not shone in 2021 as much as during 2020, but some types of strategies have posted decent returns since the start of the year. Year-to-date, strategies with a strong rates component have disappointed the most. They have been particularly hit by the unexpected change in the Fed narrative regarding rate hikes. The trade positioning for a US yield curve steepening was a very significant p&l detractor from June onwards. Strategies that are more diverse in the assets they trade have performed relatively well, benefiting from winning positions in equities, currencies and commodities. While Global Macro funds can suffer at times from a noisy market environment, we believe they could be an interesting investment opportunity when seeking to capture asset repricing moves if a persistent upward inflation market were to materialize. We continue to favour discretionary opportunistic managers who can draw on their analytical skills and experience to generate profits from selective opportunities worldwide.

Quant strategies

Trend-following models were, on average, negative for the month, with gains on long equity positions negatively balanced by long bets on oil and sovereign bonds, particularly in Europe. Multi-strategy quant funds were flat for the month but, since the start of the year, they have generated nice returns, outperforming single-model strategies. Equity statistical arbitrage has been one of strongest p&l contributors since the start of the year.

Fixed Income Arbitrage

Since the unwinding of the steepening trade on the US yield curve, the slope has stayed more or less unchanged while the bond rally has taken a breather. In the relative-value space, swap spreads were quite stable, as was basis rate swap, minimizing opportunities for fixed-income relative-value. Nonetheless, we think that volatility is likely to come back, especially if inflation fears ultimately materialize.

Emerging markets

The repositioning of the investment community around the reflation trade generated short-term volatility on cyclical commodities and Emerging Market currencies, which were also affected by the move on the US yield curve. Emerging Markets will be natural beneficiaries of a continuation of the world’s economic recovery. However, there are important moving pieces such as COVID-19 infection levels and the resilience of world economic growth that will probably lead to higher volatility levels. Emerging Markets, although an appealing investing ground for investors seeking decent-yielding fixed income assets, are still in a fragile situation, since vaccination programmes are far behind the pace of richer nations. Although EM fundamental managers reckon the space is an interesting option in a zero-rate world, considering the fragility of fundamentals, they usually adopt a very selective approach. Caution is required, due to the higher sensitivity of the asset class to investor flows and liquidity.

Risk arbitrage – Event-driven

August was positive for Event Driven strategies, which started to recover from the two difficult months of June and July. Merger Arbitrage deal spread-risk was re-priced and adjusted to the new reality, implying higher regulatory scrutiny, specifically in the US, while bilateral tensions remained high between China and the Biden Administration. It is common belief among the merger arbitrage investment community that, although deal completions will probably take longer to close, the market is over-pricing merger-spread risk, thus offering an interesting double-digit annualized IRR. We therefore think that the opportunity set for the strategy remains very interesting, offering one of the best risk-adjusted returns.

Distressed

Stressed and distressed strategies continue to perform well. Interestingly, they remained unaffected by sector and market reversals, generating returns from idiosyncratic profitable trades and a positive risk-on sentiment. The last 12 months have been, on average, the highest performance period since the Great Financial Crisis (GFC) of 2008. The COVID crisis, managers believe, although very different in terms of its origins and its impact, will be a source of opportunity for years to come. The GFC saw the market having to deal with a financing crisis following the collapse of major financial institutions; the current financial landscape is characterized by relatively sound financial institutions but where bank financing, by force of regulation, has been replaced by support from non-banking financial institutions like hedge funds. The opportunity set is hence wide and varied. We favour experienced and diversified strategies to avoid having to face extreme volatility swings. It is not going to be easy but this is the environment and opportunity set these managers have been waiting on for the last decade.

Long short credit & High yield

Following the late Q1 2020 market crash, hedge funds opportunistically piled up IG and HY credit at very wide spreads. Managers that were able to go into offensive mode were aggressively buying on the market or making off-the-market block trades, whereas other managers, unable to meet margin calls, needed to quickly cut risk. Since then, spreads have completely reversed to pre-COVID levels. Multi-strategy managers have significantly reduced exposure to credit and high yield, as current valuations present limited expected gains and a negative risk-return asymmetry.